Snap's Ad Business Is in Serious Trouble

While it still has some tricks up its sleeve, there’s no immediate route to re-ignite revenue growth.

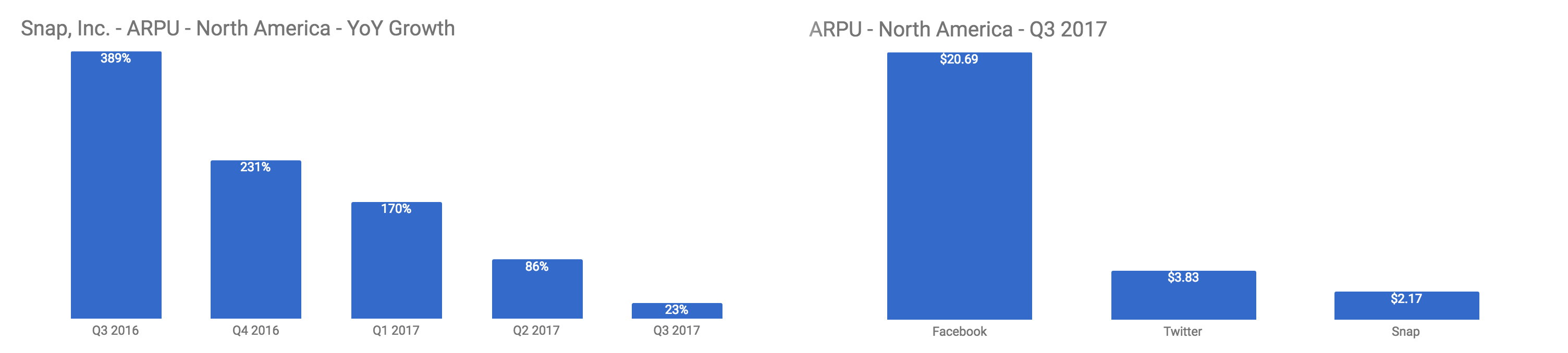

Snap, Inc.’s third quarter 2017 earnings caught notice: a $40m accounting write-down on unsold Spectacles glasses and a complete reversal on product strategy towards a re-design of the app. In Snap’s ad business, things were no better: Snap’s Average Revenue Per User is only 10% of Facebook’s, revenue growth is rapidly diminishing, and there’s no clear path to fix it. Management attributed the revenue issues to temporary changes in the ad business’s structure, but barring the outsized success of the pending product re-design, the weakness is likely permanent.

In late 2012, the magical ingredient that ignited Facebook’s massive revenue growth was mobile app advertising. These advertisers intensely measure the profitability of their ads, and found great success with Facebook. There are signs that Snap’s revenue troubles are driven by a struggle to capture this market, a billion-dollar missed opportunity.

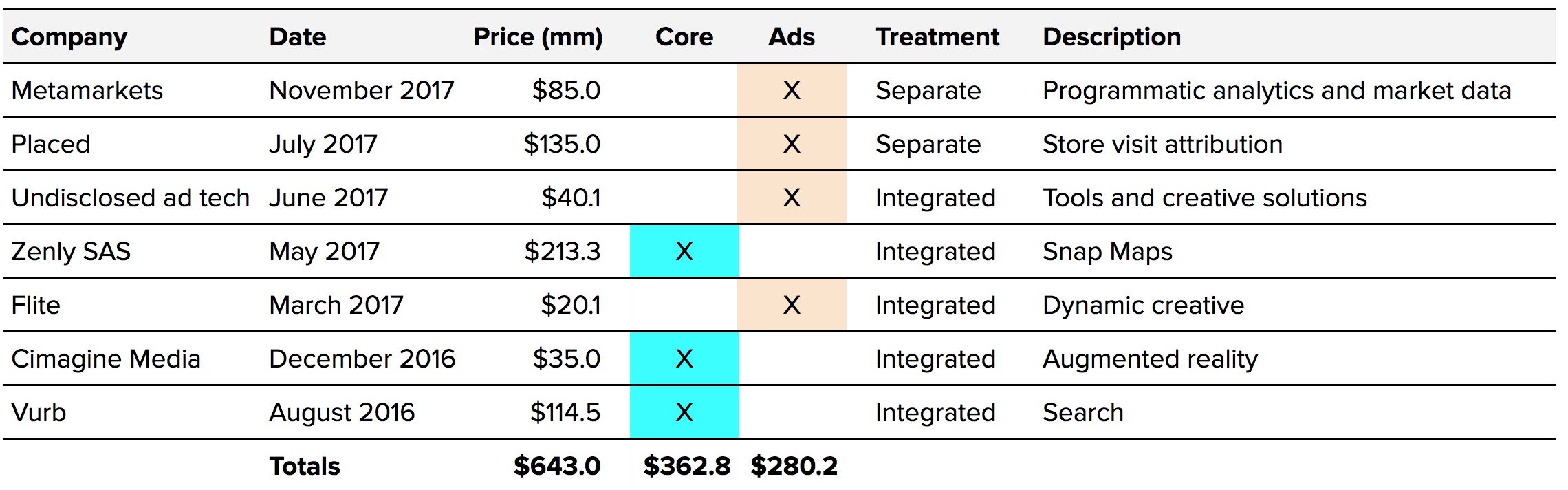

At the same time, Snap is spending hundreds of millions buying non-core ad tech companies, indicating that management is struggling to find high-leverage investment opportunities within the current business.

The Snap Ads platform is young. Ongoing improvements in how advertisers and Snap users interact will produce growth. However, until we see the magical redesign that’s currently hidden in Evan’s elevated glass office, the failure to capture app install dollars means Snap’s business will remain troubled.

Snapchat embodies “millennialism”, but its approach to monetization has been old school

Snapchat’s audience is a traditionally “premium” one — young Americans on iPhones — and that let it quickly sign old-school deals with old-school brand advertisers. These deals paid Snapchat based on the quantity of ads viewed, and these advertisers were happy to do so in order to capture the “valued 18–34 demographic.” It was less important how these views turned into revenue for the advertisers. These sales efforts were successful, and Snapchat users now frequently see see high-quality brands like Amazon Prime Video and Burberry.

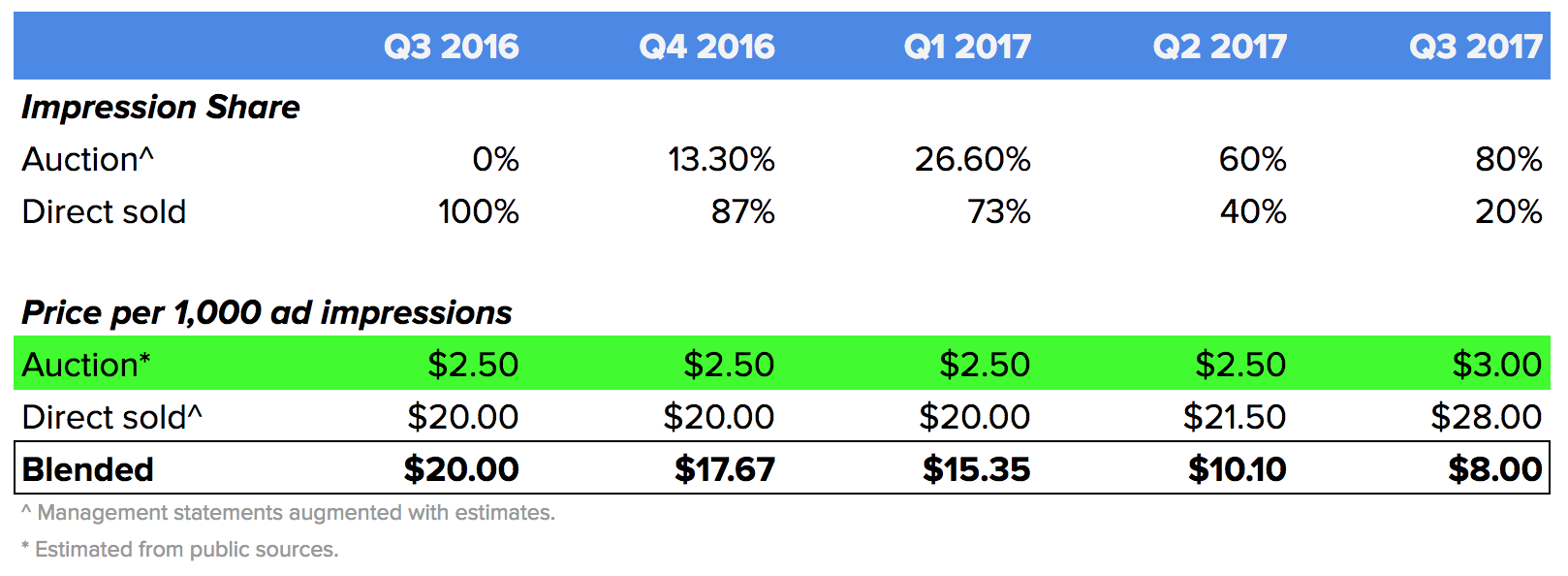

Now, as Snap transitions to a real-time ad auction, the real worth of these 18–34s is being revealed by app install and other advertisers who intensely track the performance of each ad. During the 3Q 2017 conference call, management noted a 20% drop in ad prices quarter-over-quarter, and a 60% drop year-over-year.

Joining those metrics below with other publicly reported numbers paints a picture of continually low prices for ads sold via realtime auction on Snapchat. It is not a temporary phenomenon.

Prices per 1,000 ad impressions in the $2.50-$3.00 range are only one-third of what Facebook is able to generate for a comparable US audience, according to Nanigans.

Mobile app advertisers have tested Snapchat ads for years, always on the hunt for new users who will install a new app, generate revenue, and pay for the ad buys. If they were finding results, they’d be on the platform in force and likely generating prices in excess of $3. Other statistics reinforce their absence: app advertisers religiously use third-party measurement tools that track every action caused by their ads. However, only 55% of Snap’s ad spend has third-party measurement attached, including the substantial brand spend noted above.

Tool buildout will help but not shift trajectory

Snap is investing in advertiser tools to match Google and Facebook. In fact, much of Snap’s advertiser interface resembles Facebook’s, dunked in a bucket of yellow paint. New features like the Snap Pixel will help advertisers measure website activity from their ads, and Snap is expanding a partnership program that makes it easier for new advertisers to access the platform.

Snapchat also announced new Promoted Stories and AR Trial lenses in late November that begin to bring more interactive product showcases into the app.

While these tools and new formats might add a few percent of revenue, as they don’t change the fundamental character of Snap’s audience, they’re unlikely to increase ARPU by 10x, ad prices by 3x, or re-ignite growth.

Acquisition activity implies declining opportunities

Before June 2017, Snap’s M&A strategy focused on directly enhancing the core product: augmented reality, Zenly (which became Snap Maps), and tools that made designing Snap ads easier.

Now, two new acquisitions are showing a change in strategy. In June 2017, Snap bought Placed for $135 million, which helps tie online advertising to in-store consumer spending. In October 2017, Snap bought Metamarkets for <$100 million, an analytics tool for monitoring programmatic advertising exchanges. These acquisitions add up to almost 10% of Snap’s cash.

While Placed will provide Snap with some tools for retail advertisers and Metamarkets may be able to provide a bit of analytics insight, Snap does not have a massive identity graph that would jumpstart Placed’s retail coverage nor a traditional programmatic business that would benefit from Metamarkets’ data feeds.

While these acquisitions have valuable businesses and strong teams, they are unlikely to serve as the fuel that turns Snap’s core ad business into a rocket ship. Instead, management’s expensive moves into these non-core areas implies a declining investment landscape for the core business — there is apparently not much rocket fuel to go around.

Twitter wasted hundreds of millions of dollars on expensive acquisitions like MoPub (mobile ad exchange), TellApart (retail), and TapCommerce (retargeting). There were few synergies with Twitter’s core business and tough competition, and Snap’s moves are likely to suffer similar fates.

The re-design will be a true Hail Mary play

Snapchat has to be redesigned. Not just to add users, but to change its users, who have proven to be disappointing to high-value advertisers. We’ll see how successful the company will be soon — possibly as soon as December 4th.

Investors should realize that betting on Snapchat is not participating in incremental improvement as its advertising ecosystem matures, but instead a bet on the success of a complete reboot of the Snap product.

In turn, Snapchat aficionados should hold on for some radical changes, and hold faith with the company, knowing the challenges they face.

Building a business that made more than $200 million in revenue in its most recent quarter is not something to be scoffed at, but as long as investors are comparing it to the big Internet companies, Snap will be in trouble.